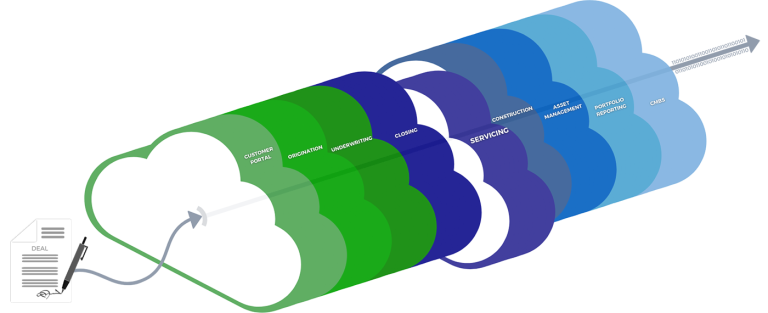

Choose the North Shore software modules that suit your business needs, keep the existing systems that are working for you… and North Shore will provide one, total, integrated loan life cycle solution for your operation.

Click on a cloud to learn more about that North Shore module!

Custom & cloud-based, North Shore provides loan life cycle solutions for every part of the process. Likewise, it is the one complete loan software suite for automating the entire commercial mortgage lifecycle from end-to-end. Essentially, the database, workflow, AI, reporting, integration, and functional modules collectively make up The CREF Operating System™. Since this is a cloud-based platform, users within a corporation can seamlessly share data across the system’s various modules with one another. Thus, eliminating potential data errors that would have otherwise arisen when using another method. This highly-configurable system was designed and built from the ground up specifically for CREF. Subsequently, it can be implemented by all types of lenders and investors, for all types of debt/equity structures, and for all property types. North Shore was created to simultaneously support multiple lines of business within an enterprise while providing specific functionality for every user role.

After over one hundred implementations of the system, the many needs and wishes of these clients have been incorporated and put into production. The adaptability and openness of the software allows customers to seamlessly mix and match its various modules with other software they utilize in-house or as a service. Ultimately, used together, all the modules form the only truly straight-through, end-to-end, all-inclusive loan life cycle solution commercially available today.