Used in conjunction with our Origination and Servicing modules, or with your existing systems, the North Shore Asset & Portfolio Management software module provides the ideal platform for housing your loans for servicing them and for tracking and aggregating performance data on the underlying assets.

Automated Data to Oversee & Track Assets

The asset & portfolio management software is a comprehensive database with state-of-the-art data capture capabilities, workflow automation, complete reporting and document preparation, and most importantly, an underlying Business Rules Engine (BRE) make up the platform. Data is fed automatically from borrower documents, appraisals, and inspections, so capacity is increased, transcription error rates go down, and surveillance is improved.

Easy & Powerful Portfolio Management Software

Powerful, easy-to-use Dashboard Design Tools allow you to build personalized views of the asset and loan data, see real-time statistics, manage workloads, and get altered to any condition. The Business Rules (BRE) drive the tasks of notifying borrowers, surveying the portfolio, and kicking out credit exceptions & alerts related to delinquencies or maturities.

Filtering & ad-hoc reporting tools give you unlimited slice-and-dice capabilities to view the portfolio from all perspectives, build asset management work queues, feed other reporting and presentation tools, and extract data for use elsewhere.

For more information on the North Shore Asset & Portfolio Management Software contact us today.

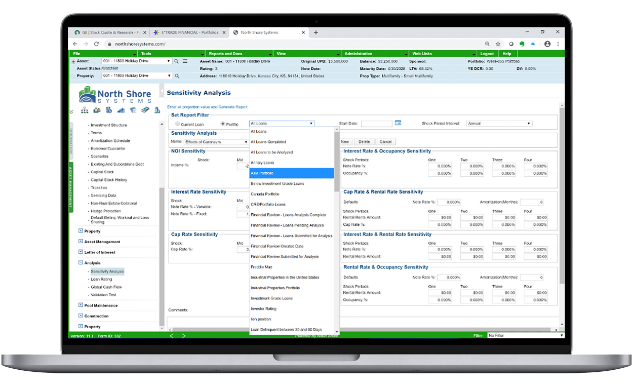

Portfolio Sensitivity:

Stress the deal, group of loans, or the whole portfolio to see the net effect of multiple shock periods.

360º Views

Total Control

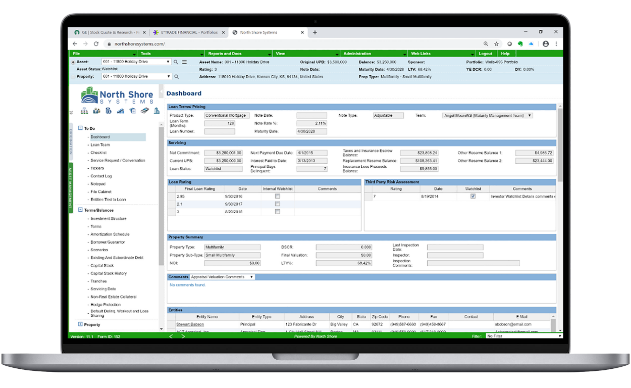

Asset Dashboard:

Get a 360 degree view of your loan and its underlying assets, including servicing balances, property performance, and outstanding asset management tasks and reports.

Features & Functions

- Portfolio mix & concentration reports

- Risk Based Capital

- Borrower Exposure

- Dynamic trend analysis

- Exception reports

- Economic impact analysis

- Comparable reporting

- Market data

Asset Management

- Rules-based portfolio surveillance & asset management

- Automatic Property Financials requests

- Property Inspection scheduling and capture

- Initial & Continuing Valuations

- Disposition & Business Plan Write-up & Approval

- Appraisal Tracking

- Borrower Notifications, Document Tracking and repository

- Ratings, Risk Analysis & Loss Protection

- Portfolio & Regulatory Reporting

- Budgeting & Cash Management

- Over 2,500 Data Elements

- Mobile Site Inspections

Project/Portfolio Management

- Portfolio mix and concentration reports

- Risk Based Capital

- Borrower Exposure

- Dynamic trend analysis

- Exception reports

- Economic trend analysis

- Comparable reporting

- Market data

- Production and performance reports

- Auto Roll-up/Controls

- Multiple Reporting Options

- User-defined Filtering

- Stress Testing

- Rules-based Loan Ratings

- Annual Reviews

- Excel Integration

- Notice Generation

- API Calls for Ongoing Scoring

- Service Requests/Workflows

Benefits

decrease in paper usage

increase in data received & digitally sent

less time required to generate annual reviews (% closed)

improvement in metrics quality

reduction in cost of processing incoming documents