CMBS/conduit lenders and their borrowers can use the CMBS software module of the structure loans of CMBS market and to analyze pools of loans that fit investor and bond-structure criteria

The modules’ functionality spans both the Origination and Servicing/Asset Management modules, as pooling can be performed using loans from either the pipeline or portfolio. Bond structures and ratings can be tracked and reported on, along with the securitization entities and associated expenses.

Powerful Functional CMBS Software

Like the other North Shore modules, the CMBS functionality is extremely flexible and powerful, powered by the underlying Business Rules Engine, Document Preparation, and Workflow Automation.

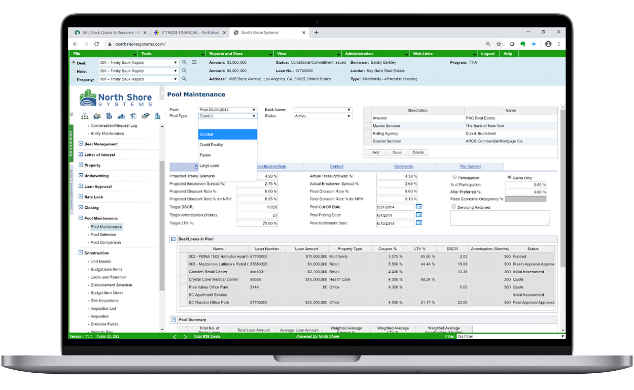

Pool Maintenance

Build pools of different types with both loans from the Pipeline and from the Portfolio, with tracking entities, tranches, and expenses relating to the offering.

With a Single Click

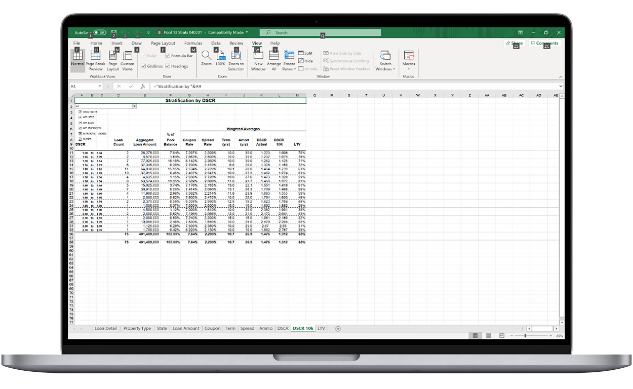

Stratification and Excel Integration:

Data is easily filtered and extracted into excel for data tapes and start files.

Features & Functions

- Excel Integration

- Rule-Based Underwriting and Pooling

- Build Pools and Perform What-If Scenarios

- Track Bond Details and Participants

- Closing and Securitization Checklists

- CREFC Investor Reporting Package

- Loan or Pool Import/Export

- Asset Summaries

- Rating Agency Tape Creation

- On-Going Asset Administration

- Pool Analysis/Statistics & Reporting

Benefits

reduction in time building pools

CREFC compliant

of borrower/ investor data received/ delivered digitally

decrease in time to generate pool strat’s

reduction in number of spreadsheets used

less time building tapes